Editor's Note: This post was originally published in August 2015. It has been updated for relevance and richness of content in February 2020

Eyewear Industry Stats 2020

Published by Madhu Singh on

Tue, Feb 18, 2020 @ 10:02 AM

Researching eyewear and industry trends takes time whether it's through reading articles, discussing with your peers, or going to retail stores yourself. That's why we're here to do that work and let you focus on delivering better patient care.

Today, we'll be focusing on the stats and future trends that will influence your customer's purchases. Understanding where the industry is going can help you with pricing, marketing, and sales strategies for your opticians.

2020 Eyewear Trends

- $141.3 billion industry

- $73 billion from men's eyewear

- expected to reach $215 billion by 2025

- $18.23 per capita revenue by 2023

- Average $8,553 consumer spending per capita by 2023

- Largest market: North America

- ~38% of market share

- Fastest Growing: Asia Pacific

- 13.5% growth

- 89.7% of sales are brick & mortar retail, the rest is online

- 21% of all sales will be online by 2023

- Key Players: EssilorLuxottica, Johnson & Johnson, HOYA Corp, Carl Zeiss

- 4.69% growth rate until 2024

- Corporations investing and acquiring augmented reality or other new technology

Online marketing and promotion will be the key to combatting the number one growth obstruction: accessibility to affordable products and care. Making your practice known and creating budget-friendly solutions will boost your competitive edge for the next 4 years.

- Demand for sports sunglasses is rising

- Key Players: EssilorLuxottica, Nike, De Rigo Vision, Safilo Group SpA, Marcolin SpA

- Competition is high and fragmented across the globe with many counterfeit or low-quality brands interfering.

- Designer sunglasses continue to be strong in the market because they have become statements of luxury and wealth.

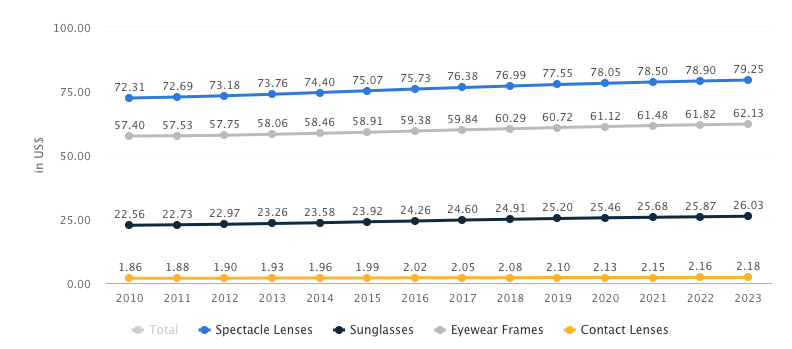

Price per Unit by Product Line

- Electronic focusing eyeglasses could transform bifocal or omnifocal industry

- 12% growth rate for contact lenses

- AR technology could create smart lenses

- Bluetooth can monitor eye pressure and blood glucose

We hope this has helped you identify the gaps in your practice's products, growth forecast, and 5 year plan.

If you don't already have a five year plan for your practice, make one here with our template.

Tags:

Resources

Global

Global