4 Reports to Increase Optical Practice Revenue

How often do you read your claim filing reports from your practice management system or clearinghouse? You can be honest here. If your answer is “not very often” or “not at all,” you’re not alone! Most practices say that they only check their reports when they notice that a claim hasn’t been paid.

Unfortunately, by the time you realize that a claim hasn’t been paid, you might find out that the same is true for every other claim using that code because of a coding error. It could also mean that there are other similar claims that are not fully reimbursed.

On busy days in a billing office, it can be challenging to find the time to look at reports, especially when unread reports start to accumulate. But if you don’t take the time to read these reports, you won’t find problem claims that require attention!

Reviewing your claims reports should be a continuous process. Start getting in the habit of setting time aside to check your reports regularly. Check out the 4 reports that you should be monitoring frequently.

4 Reports To Help Increase Revenue and Decrease Denied Claims

Ideally, you should monitor these reports on a weekly basis, but no less than once a month:

- Accepted claims report

- ERA reports

- Aging reports

- Accounts receivables

Accepted Claims Report

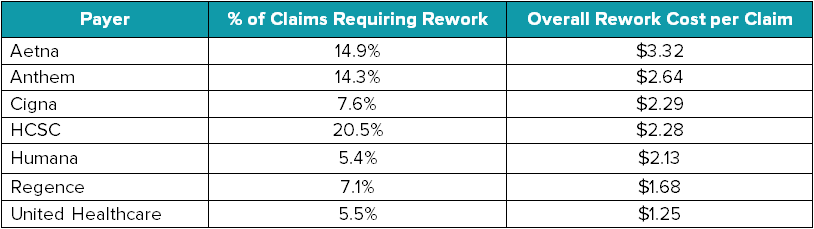

How many of your filed claims get accepted and rejected weekly and monthly? For an industry benchmark, check out the examples compiled by the American Medical Association, showing the difference between denial metrics of payers.

Keep in mind that the percentage of claims that require rework shown above include denied and rejected claims. The percentage of rejected claims in your practice should be lower than the numbers shown.

Aging reports

How much is owed to your practice by patients and insurance companies? Monitor aging reports to identify ignored claims that need attention.

ERA reports

Are all of your claims reconciled? Are the liabilities being transferred accurately between patient and insurance or do they get written off? Is there proper documentation when balances are written off? These are important things to look out for in your ERA report.

Account Receivables

How old are your account receivables? A healthy range is to have 40-60% of invoices sit in accounts receivables between 0-30 days.

These reports are usually provided by your clearinghouse or practice management system. Find a solution or a provider who can provide detailed reporting so you can stay on top of your claims through every step of the process!

Want to find out more ways to prevent denied claims? Download our eBook, “8 Claim Filing Trends to Say Goodbye to” and find your way to a successful claims management process.